P&L / 1099 Only Loans

Simplified Income Verification Loan Solution

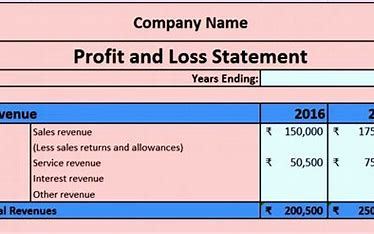

The Simplified Income Verification Loan Solution is tailored for self-employed individuals, freelancers, and independent contractors who may find it challenging to qualify for traditional loans due to the nature of their income documentation. By focusing on Profit and Loss (P&L) statements and 1099 forms only, this program streamlines the application process, offering a more accessible financing solution for personal or business needs. Our objective is to provide a flexible lending option that recognizes the value and reliability of non-traditional income documentation, enabling more borrowers to achieve their financial goals.

Key Features:

- Eligibility: Designed specifically for self-employed individuals, freelancers, and independent contractors with verifiable income through 1099 forms or P&L statements.

- Income Verification: Simplified income verification process relying solely on P&L statements for the most recent fiscal year or 1099 forms.

- Loan Types: A variety of loan types available, including personal loans, business loans, and mortgage loans, to suit different financial needs and goals.

- Competitive Rates: Offers competitive interest rates tailored to the unique circumstances and creditworthiness of each applicant.

- Flexible Terms: Loan terms that can be adjusted to match the borrower's payment capability and financial situation.

- Quick Processing: Streamlined application and approval process designed to provide quick access to funds.

- Loan Amounts: Varied loan amounts to accommodate a wide range of financial needs, from small personal loans to larger business investments.

Application Process:

1. Initial Consultation: Contact our loan specialists for an initial discussion about your financial needs and to learn more about the program specifics.

2. Document Submission: Provide your most recent P&L statement or 1099 forms as the primary documents for income verification.

3. Loan Application: Complete the loan application form, including details about your income, desired loan amount, and preferred loan terms.

4. Review and Approval: Our team will review your application and documents to assess eligibility and determine the loan offer.

5. Closing: Once approved, you will receive detailed information about the loan terms, and upon acceptance, the loan agreement will be finalized for disbursement of funds.

Support and Guidance: Our team is committed to providing personalized support and guidance throughout the application process, ensuring that you understand all aspects of the loan agreement and how it fits within your financial landscape.

Advantages for Non-Traditional Earners: This program is built to support the financial stability and growth of individuals with non-traditional income patterns, offering a solution that acknowledges the diverse ways in which people earn and report income in today's economy.

Contact Information: For more information about the Simplified Income Verification Loan Solution or to begin your application, please contact our lending team at 718-331-6900 or email us at info@congresscapitalgroup.com

Disclaimer: Loan approval is subject to credit review and underwriting criteria. Terms and conditions apply. Rates and terms are subject to change based on market conditions and borrower eligibility. Please contact us for the most current information and to discuss your specific needs.